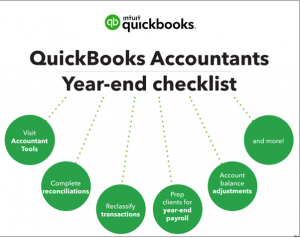

The year’s end will be here before we know it. You can support your group and your customers get ready for every one of those very late errands in QuickBooks by utilizing this Year-end agenda.

Visit Accountant Tools

- You can achieve everything from renaming exchanges, total incomplete compromises, or run your preliminary parity in anticipation of recording government forms in Accountant Tools.

- When you get a handle on open to shutting the year, you can likewise Close the books and anticipate undesirable changes before recording your expenses.

Discount collectible obligations

- Do any of your customers have uncollected obligations during the present time frame? You can discount solicitations esteemed uncollectable to deal with any terrible obligation before year-end.

- If you have to discount the receipt in a shut period, figure out how to discount awful obligation for more established sections.

Set up default date extends on reports

- Save time by setting up default date goes on your reports so every time you open a report, it will open to the right year-end date run.

- Remember, Report and Tool defaults additionally influences different devices, for example, Reclassify Transactions.

Right categorized exchanges

- Save time by utilizing the Reclassify Transactions apparatus to cluster right record or class task mistakes for different exchanges on the double.

Prep for year-end finance assignments

- It’s never too soon to urge your customers to get a head start on finance. The assignments spread out in this guide will assist you with finishing off 2019 effectively and assist them with getting ready for 2020.

- Select the finance item your customer uses to see the fitting finance year-end agenda.

- Year-end agenda for QuickBooks Online Payroll Enhanced

- Year-end agenda for QuickBooks Online Payroll

- Year-end agenda for Intuit Online Payroll Full Service

- Year-end agenda for Intuit Online Payroll Enhanced

- Year-end agenda for QuickBooks Payroll Desktop Assisted

- Year-end agenda for QuickBooks Desktop Payroll

Complete incomplete compromises

- Do any of your customers have incomplete compromises that need consideration? Assist them with fixing any compromise inconsistencies or even fix past compromises for their sake varying.

Make account balance modifications

- Do any of your customers’ record adjusts need minor changes? It’s a smart thought to run an Adjusted Trial Balance Report to ensure all charges and credits equivalent out.

Use Prep for charges

- Now that every one of your alterations have been entered, utilize the Prep for charges highlight to prepare sure you’re to finished your customer’s assessment form.

Record your assessments

- Kick off your customers’ expense forms from the Clients Tab and interface with Reconnect to finish the arrival.

But are you facing any issues in doing so or the steps do not seem to be clear for you then contact our QuickBooks Customer Support representative or you may even send us an email at support@quickbookssupport.net

Comments are closed.